Haryana Real Estate Regulator Authority’s H-Rera Gurugram bench, while disposing of 26 cases related to non-payment of assured returns tO investors, has made it clear that contractual obligation or cite a new pact being executed because of the Rera Act coming into effect in 2016.

H-Rera chief KK Khandelwal said the cases that were heard largely pertained to one city-based developer. He hoped the regulator’s order on Wednesday would help realise crores of rupees due from developers, “who have arrogantly and mischievously refrained from paying assured returns” after collecting 100% payment from investors.

In a statement, H-Rera’s Gurugram bench said, “This decision of the authority is significant and shall go a long way in curbing/regulating the malpractice by the promoters of raising funds by floating dubious deposit schemes such as assured returns schemes.”

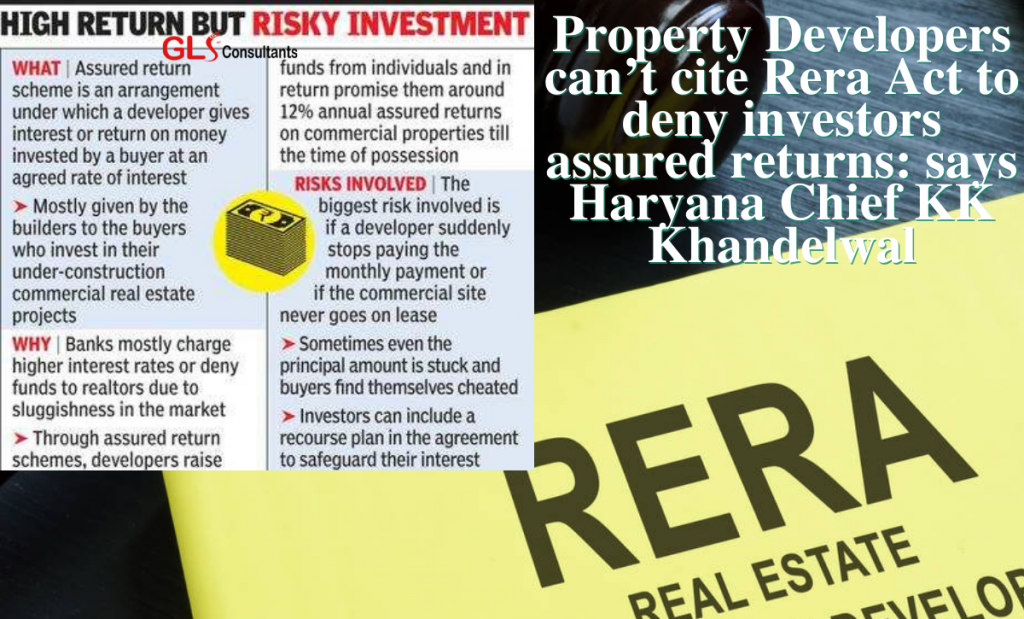

According to Khandelwal, several cases have been filed before the regulatory authority, with aggrieved allottees accusing real estate developers of luring them into investing in realty projects by promising a certain rate of monthly returns on the money deposited as consideration against the unit’s price.

“The assured returns schemes often appear very lucrative to buyers as they are promised an assured rate of interest and also possession of the property on the agreed date of completion,” Khandelwal said.

While pronouncing Wednesday’s judgment, the authority, relying on the view taken by the Bombay high court on Neelkamal Realtors Suburbans case, held that the Real Estate (Regulation and Development) Act, 2016, has no provision for re-writing of contractual obligations between the parties. “Therefore, the developers cannot be allowed to take a plea that there was no contractual obligation to pay the amount of assured returns to the allottees after the Rera Act, 2016, came into effect or that a new agreement is being executed with regard to that fact,” Khandelwal said.

In its judgment, the regulator also made it clear that in disputes pertaining to assured returns schemes, money was taken by developers as advance deposit against allotment of immovable property and possession was to be offered to the allottee within a certain period in line with the builder-buyer pact.

“By taking sale consideration by way of advance, the builder promised certain amount by way of assured returns for a certain period, therefore on the failure on part of the builder to fulfil its commitment, the allottee has a right to approach the authority for redressal of grievance by way of filing a complaint,” it said. A city-based real estate agent said assured returns are a way of developers to raise funds that helps them avoid going to the bank wherever possible for loans. “The developer also executes a formal agreement with the buyer for the same,” the agent said. In commercial properties, the assured returns promised are up to 12%. “Many investors find it a lucrative investment because of assured returns,” said a real estate consultant.